Use these links to rapidly review the document

Table of ContentsUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Soliciting Material under §240.14a-12

RITE AID CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒

No fee required.

☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

☐

Fee paid previously with preliminary materials.

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

| | | |

| | Filed by the RegistrantýRite Aid Corporation

|

Filed by a Party other than the Registranto30 Hunter Lane |

Check the appropriate box: |

oCamp Hill, Pennsylvania 17011 |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | | |

RITE AID CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý | LETTER FROM OUR CHAIR

AND CHIEF EXECUTIVE OFFICER |

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) | | Aggregate number of securities to which transaction applies:

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | (2) | | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| | (4) | | Date Filed:

|

DEAR FELLOW STOCKHOLDERS:

As we consider the past year, three words consistently rise to the top: Determination, progress and resilience.

We, and the entire Rite Aid Board of Directors, are immensely proud of the more than 50,000 associates that worked through pandemic-related challenges to keep their communities healthy and thriving. Our collective determination to help customers manage through the pandemic, while also transforming our organization, actually accelerated our work to be a demonstrably different company in just one year. Our associates have shown resilience in every aspect of our business, from pivoting daily on COVID-19 testing and vaccines to positioning new brands and merchandise, and keeping stores, distribution centers, mail order facilities and call centers open, all without missing a beat. This determination has been a differentiator for the organization. And so, in a year like no other, we have made significant progress in creating a whole new Rite Aid and setting the foundation for enhanced stockholder value.

We are also pleased to report on our progress aligned with our purpose. We demonstrated that we can deliver on our core mission of keeping our communities healthy and thriving, and at the same time position ourselves for a successful future. Despite the challenges posed by COVID-19, our teams are clear on what needs to be done in Fiscal Year 2022: win today and in the future by creating real health care value, improving consumer engagement, and transforming our work to improve financial performance.

As we move into the second year of implementing our strategic plan, we are focused on:

•

Accelerating our RxEvolution plan:

Our initiatives are focused on three primary areas: 1) Managing Elixir client costs via seamless member engagement and better health outcomes; 2) Unlocking the value of our pharmacists; and 3) Transforming our retail and digital experience. We begin Fiscal Year 2022 with a newly branded and integrated pharmacy benefit manager (PBM) poised to expand its large and growing addressable market, a new retail brand, enhanced store footprint and merchandise assortment, more than 6,400 pharmacists who are whole health advisors serving their communities, and an incredible and energized team. More than ever, we are able to deliver on growth opportunities in retail and pharmacy service segments.

•

Defining Rite Aid as a health care company:

The pandemic validates our conviction that pharmacists are indeed the last mile connectors between the health care system and consumers. Although many may think of Rite Aid as a retailer, we are at our core a health care company, serving more than a million customers every day through our more than 2,500 retail stores, our pharmacy services call center, our mail order and specialty pharmacies, and through clinical and analytical services powered by our subsidiary, Health Dialog. Our personal connection to our customers through our trusted pharmacists is an important part of the future of health care in America. We are committed to fundamentally changing our role in health care and becoming the industry leader in whole health.

LETTER FROM OUR CHAIR AND CHIEF EXECUTIVE OFFICERTable •

Becoming a more efficient operator:In Fiscal Year 2021, we extended all but $91 million of Contentsour calendar 2023 bond maturities to calendar 2025 and 2026, and ended the year with $1.7 billion in liquidity, which gives us ample flexibility to execute our strategic initiatives. As we executed our strategic plan, we increased revenues in both the retail pharmacy and pharmacy services segment, and grew market share

June 7, 2019 in both retail and pharmacy in a highly competitive environment. Additionally, the Company implemented LEAN initiatives both to reduce working capital tied to inventory and improve our retail pharmacists’ productivity. We also reduced back office costs through consolidating administrative functions in our retail and pharmacy services lines of business into a more efficient structure.

•Dear Fellow Stockholders: Enhancing our ESG practices:

We continue to make progress in our ESG efforts, including fleet fuel reduction, decreased energy usage, and our continued progress in eliminating chemicals of concern. In addition, we performed an enterprise climate risk assessment, responded to CDP’s climate change questionnaire, and invested in our associates through numerous program enhancements to keep them engaged. We are proud of the racial, ethnic, and gender diversity of our Board of Directors (88% of whom are racially diverse or female) and our executive leadership team (50% of whom are racially diverse or female), and are expanding our Diversity, Equity and Inclusion efforts in Fiscal Year 2022.

On behalf of the Board of Directors, (the "Board") of Rite Aid Corporation ("Rite Aid" or the "Company"), I want to take this opportunitywe would like to invite you to attend our 2019virtual 2021 Annual Meeting of Stockholders. The meeting will be held at 8:30 a.m., local time, on Wednesday, July 17, 2019, atStockholders, where we plan to share with you the office of Skadden, Arps, Slate Meagher & Flom LLP, Four Times Square, New York, NY 10036. Atprogress we are making toward our vision and strategy for the Company.

Instructions for joining the meeting stockholders will vote on the proposals set forthare contained in the Noticesection of the Proxy Statement titled “Information About the Annual Meeting and the accompanying proxy statement. At Rite Aid, we remain focused on taking actions to best position the Company to create long-term value for stockholders. These include actions to use our unique capabilities to help payors deliver a high level of care to patients, to re-imagine our front end to offer the selection of products and services that meet the needs of our target customers and to transform our processes and procedures to ensure strong cost discipline and achieve peak operational efficiency.

Our actions to create long-term value for stockholders include our efforts to enhance the quality of our Board by bringing in fresh perspectives and valuable expertise and experience. A majority of Rite Aid directors have joined the Board in the past eight months, with Bob Knowling, Lou Miramontes and Arun Nayar joining in October 2018 and Busy Burr and Kate Quinn joining in April 2019. In addition to their wealth of knowledge and experience, these changes to our Board bring a diversity of thought, as well as enhance our Board's gender, racial, and ethnic diversity.

As we have said previously, one of the Board's most important tasks is choosing the Company's Chief Executive Officer. In March, we announced a leadership transition and organizational restructuring to better align the structure and leadership of Rite Aid with its present scale. As part of this transition, we are currently in the process of searching for a new CEO. The Board recognizes the significance of this task and is conducting its process in a thoughtful and deliberate manner.

Both before and since the 2018 Annual Meeting, we have increased our efforts to engage with many of our larger stockholders and we value the input they have provided. In response to votes held at the 2018 Annual Meeting and engagement thereafter, we have enhanced our corporate governance structures by requiring the separation of the Chairman of the Board and CEO positions and by providing stockholders with the right to call special meetings.

With respect to executive compensation, we took steps to further align pay and performance, including increasing the emphasis on performance-based (rather than time-based) long-term incentives for fiscal 2019 and refining our peer group for fiscal 2020 to, among other things, remove industry peers that are no longer appropriate data points given their significantly larger scope of operations.

We continue our efforts to ensure that Rite Aid's business is operated in a sustainable and socially responsible manner. In addition to moving forward on the sustainability and opioid-related reports that stockholders voted for at the 2018 Annual Meeting, in April 2019, we announced enhanced efforts to promote responsible access to tobacco products by increasing the age to purchase tobacco products to 21 and removing e-cigarettes and vaping products chain-wide. We are also continuing to enforce our chain-wide "ID All" policy that requires identification to purchase age-restricted items, including tobacco products. The Board continues to receive reports from management on sustainability and opioid-related matters.

Voting.”

Table of Contents As referenced above and described further in the accompanying proxy statement, we at Rite Aid have taken or are in the process of taking the actions that we said we would take—refreshing our Board, reinvigorating our corporate governance practices and policies, assessing management's performance, aligning pay for performance, overseeing the development of strategic initiatives, and being responsive to issues raised by our stockholders. We look forward to continuing to engageour work with you.

Your vote is important to us. Please vote as soon as possible even if you plan to attend the Annual Meeting. We appreciate your continued ownership ofoutstanding Rite Aid sharesteam to support the needs of our customers and drive growth, improved performance, and stockholder value. Thank you for your support.

investment in Rite Aid.

| | Sincerely, | | | Sincerely, | |

| | | Sincerely, | | | |

|

| BRUCE G. BODAKEN

|

|

|

Bruce G. Bodaken

ChairmanChair of the Board | | | HEYWARD DONIGAN

President, Chief Executive Officer and Director | |

May 20, 2021

Refer to the section titled

"Cautionary“Cautionary Statement Regarding Forward-Looking

Statements"Statements” for a discussion of risks and uncertainties that could cause actual results to differ materially from those projected.

Growth in market share was measured by IRI, a leading provider of

Contents

RITE AID CORPORATION

P.O. BOX 3165

HARRISBURG, PENNSYLVANIA 17105

market data and analytics, in areas where Rite Aid operates and excludes tobacco, cigarettes, greeting cards, and online sales.

NOTICE

TABLE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on July 17, 2019To Our Stockholders:

CONTENTS

| | | | | | | | Rite Aid Corporation

30 Hunter Lane

Camp Hill, Pennsylvania 17011 | |

| | | | | | NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | | |

| | ![[MISSING IMAGE: tm217739d1-icon_calendarpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d1-icon_calendarpn.jpg) WHEN WHEN | | | VIRTUAL MEETING | | | ![[MISSING IMAGE: tm217739d1_ic-pencilpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d1_ic-pencilpn.jpg) RECORD DATE RECORD DATE | |

What:

| | Our 2019 Annual Meeting of Stockholders |

When:

| | July 17, 2019 at 8:7, 2021

11:30 a.m., local timeEastern

Daylight Time | | | www.virtualshareholdermeeting.com/RAD2021 | | | Close of business on

May 10, 2021 | |

| | Proposal | | | Board Recommendation | |

Where:

| 1 | Office

| | Election of Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New York, NY 10036 |

Why:

| | At this Annual Meeting, stockholders will be asked to:

|

| | | | 1.

| | Elect eightnine directors to hold office until the 20202022 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified;

| | | | | | FOR all nominees | |

| | 2 | | | 2. | | RatifyRatification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm;firm | | | | | | FOR | |

| | 3 | | | 3. | | Approve, on an advisory basis,Advisory vote to approve the compensation of our named executive officers as presented in the proxy statement; | | | | | | FOR | |

| | 4 | | | 4. | | Consider and vote on a stockholder proposal, if properly presented at the Annual Meeting; and |

| | | | 5. | | Transact such other business as may properly come before the Annual Meeting or any adjournment or postponementApproval of the Annual Meeting.Rite Aid Corporation Amended and Restated 2020 Omnibus Equity Incentive Plan | | | | | | FOR | |

The close

In addition, we will transact any business properly presented at the meeting, including any adjournment or postponement by or at the direction of business on June 6, 2019 has been fixed as the record date for determining those Rite AidBoard of Directors. For information regarding how to access the list of stockholders entitled to vote at the meeting, see “Information About the Annual Meeting and Voting—Is there a list of stockholders entitled to vote at the Annual Meeting. Accordingly, only stockholders of record at the close of business on that date will receive this notice of, and be eligible to vote at, the Annual Meeting and any adjournment or postponement of the Annual Meeting. The above items of business for the Annual Meeting are more fully describedMeeting?” in the proxy statement accompanying this notice.Proxy Statement.

Your vote is important.VOTING

Please read the proxy statement and the instructions on the enclosed proxy card and then, whether or not you plan to attend the Annual Meeting in person, and no matter how many shares you own, please submitHave your proxy promptly by telephone or via the Internet in accordance with the instructions on the enclosed proxy card or by completing, datingvoting instruction form in hand, with your individual control number, and returning your proxy card infollow the envelope provided. This will not prevent you from voting in person at the Annual Meeting. It will, however, help to assure a quorum and to avoid added proxy solicitation costs.instructions. You may revoke your proxy at any time before the vote is taken by delivering to the Secretary of Rite Aid a written revocation or a proxy with a later date (including a proxy by telephone or via the Internet) or by voting your shares in person at the Annual Meeting, in which case your prior proxy would be disregarded.

| | PHONE | | | INTERNET | | | ![[MISSING IMAGE: tm217739d1_icon-qrreaderpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d1_icon-qrreaderpn.jpg) MOBILE DEVICE MOBILE DEVICE | | | ![[MISSING IMAGE: tm217739d1_ic-mailpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d1_ic-mailpn.jpg) MAIL MAIL | | | ![[MISSING IMAGE: tm217739d1_ic-chatpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d1_ic-chatpn.jpg) VIRTUAL MEETING VIRTUAL MEETING | |

| | Call

1-800-690-6903

(toll-free), 24/7 | | | Visit

www.proxyvote.com,

24/7 | | | Scan the

QR code | | | | | | Mark, sign and

date your proxy

card or voting

instruction form

and return it in

the postage-paid

envelope | | | During the virtual

meeting, go to

www.virtualshareholder

meeting.com/RAD2021 | |

| | | IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON JULY 7, 2021 | | |

| | | | | |

| | | Your vote is important. Please read the Proxy Statement carefully and submit your vote as soon as possible. The Notice of Availability is being mailed and the proxy materials made available on or about May 20, 2021. The proxy statement and annual report, as well as the Company’s proxy card, are available at www.proxyvote.com. | | |

| | | | | | PROXY STATEMENT SUMMARY | | |

This Proxy Statement Summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of

Contents

RITE AID CORPORATION

P.O. BOX 3165

HARRISBURG, PENNSYLVANIA 17105

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To Be Held on July 17, 2019

Important Notice Regarding the Availability ofinformation you should consider, so please read the entire Proxy Materials forStatement carefully before voting. References to “Rite Aid,” “Rite Aid Corporation,” the

Stockholder Meeting to be Held on July 17, 2019:

The “Company,” “we,” “us,” or “our” in this proxy statement and annual report, as well as the Company's proxy card,accompanying notice and letters to stockholders refer to Rite Aid Corporation and/or its affiliates. Rite Aid Corporation, a Delaware corporation, owns multiple subsidiary companies which operate Rite Aid stores and pharmacies and other affiliated companies. The term “affiliates” means direct and indirect subsidiaries of Rite Aid Corporation and partnerships and joint ventures in which such subsidiaries are available at

partners. References herein to “associates” refer to employees of our affiliates.

www.proxyvote.com.

This proxy statement is being furnished to you by the Board of Directors (the "Board"“Board” or "Board“Board of Directors"Directors”) of Rite Aid Corporation (the "Company" or "Rite Aid") to solicit your proxy to vote your shares at our 20192021 Annual Meeting of Stockholders (the "Annual Meeting"“Annual Meeting”). The Annual Meeting will be held on July 17, 20197, 2021 at 8:11:30 a.m., local time,Eastern Daylight Time, by live audio webcast at www.virtualshareholdermeeting.com/RAD2021.

The following proposals will be on the officeagenda for the Annual Meeting:

| | Proposal | | | Board Recommendation | | | See Page | |

| | 1 | | | Election of nine directors to hold office until the 2022 Annual Meeting of Stockholder | | | | | | FOR all nominees | | | | |

| | 2 | | | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm | | | | | | FOR | | | | |

| | 3 | | | Advisory vote to approve the compensation of our named executive officers | | | | | | FOR | | | | |

| | 4 | | | Approval of the Rite Aid Corporation Amended and Restated 2020 Omnibus Equity Incentive Plan | | | | | | FOR | | | | |

BUSINESS STRATEGY AND PERFORMANCE IN FY 2021

Rite Aid’s RxEvolution strategy was originally announced on March 16, 2020. Rite Aid strives to fundamentally change our role in health care and become the industry leader in WHOLE HEALTH. Our goal is to engage customers to get beyond healthy and get thriving.

Our strategy is composed of

Skadden, Arps, Slate, Meagher & Flom LLP, Four Times Square, New York, NY 10036. This proxy statement,three main pillars:

RITE AID CORPORATION 2021 Proxy Statement | 1

Rite Aid seeks to deliver a fresh, differentiated experience across all channels by targeting our growth customer—women between the foregoing noticeages of 25 to 49 who take care of themselves, their children, aging parents, and even pets. During the accompanying proxy card are first being mailedpast year, the Company has been building the foundation for an elevated customer experience. Rite Aid has been:

•

establishing supplier relationships focusing on or about June 7, 2019enhancing our assortment of “on-trend” and better for you merchandising;

•

resetting over 75% of front-end sales categories according to our new merchandising standards;

•

delivering new and enhanced product training, tools, and work processes to all holdersin-store associates;

| | | | | |

| | | Customers are taking notice as the look and feel of our stores are refreshed, our merchandising mix evolves to an assortment that best supports whole health, and perhaps most importantly, our trusted neighborhood pharmacists are empowered and qualified to consult not simply on traditional medicines, but alternative remedies as well. We’re seeking to redefine an industry, and aspire to get each one of our customers to thrive.” | | |

| | | —JIM PETERS, Chief Operating Officer | | |

•

leveraging the LEAN methodology to free up pharmacists’ time to consult with our customers on their whole health;

•

modernizing our e-commerce infrastructure and online experience; and

•

physically refreshing the exterior of our common stock, par value $1.00 per share, entitled to votefleet of stores.

This comprehensive approach is aimed at helping customers achieve a level of well-being that goes beyond traditional perceptions of healthy.

Elixir, our pharmacy benefits and services company (PBM), represents a significant growth opportunity for Rite Aid. In the Annual Meeting. Atpast year, we have rebranded the business, built a stronger, integrated offering, and created operational alignment and synergies, positioning the organization for strong growth and improved profitability. We are establishing a clearly differentiated market leader through compelling health care services offerings and outstanding digital engagement, through the connection of over 2,500 Rite Aid retail stores, and over 60 Bartell Drugs retail stores, which Rite Aid acquired in Fiscal Year 2021. Elixir’s primary market differentiator is that it is the only payor-agnostic PBM with a retail pharmacy footprint and a health care analytics and engagement company, Health Dialog.

As a health care company with a retail footprint that operates in many communities throughout the country and engages over one million customers per day through our various lines of business, we believe we are uniquely positioned to continue making a meaningful difference in the lives of our customers, associates, and neighbors.

Keeping Our Communities Safe During the COVID-19 Pandemic

In the face of the unprecedented COVID-19 pandemic, Rite Aid has been on the front lines of health care delivery in many of the hardest-hit cities across America. Our response to this proxy statement, we referglobal crisis is closely tied to our employees as associates.

corporate social responsibility efforts. We were proud to join the QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

White House COVID-19 Response Working Group

Who is entitled in March 2020 and help significantly expand the nation’s self-swab testing capacity. As of April 15, 2021, we had over 1,200 COVID-19 drive-thru testing locations where we offer free COVID-19 testing to vote at the Annual Meeting?anyone over age 4, regardless of symptomatic status.

Holders of

In February 2021, Rite Aid common stock asjoined the Federal Retail Pharmacy Program to provide coronavirus vaccines. At the outset, Rite Aid received federal allocations of the closePfizer and Moderna vaccines in seven jurisdictions. As of business on the record date, June 6, 2019, will receive notice of, and be eligible to vote at, the Annual Meeting and any adjournment or postponement of the Annual Meeting. At the close of business on the record date,April 15, 2021, Rite Aid had outstandingadministered approximately 2.5 million COVID-19 vaccines across 19 jurisdictions in nearly half of our stores and entitled to vote 53,828,701 shares of common stock. No other shares of in nearly 700 clinics, including clinics for vulnerable or underserved populations.

Rite Aid capital stock are entitledalso has undertaken efforts to noticeeducate our communities about COVID-19 testing, vaccine eligibility and availability, vaccine safety, and measures we take to keep our associates, customers, and communities safe through a COVID-19 information resource on our website, at www.riteaid.com/covid-19. Except as stated otherwise, information on our website is not considered part of and to votethis Proxy Statement.

2 | RITE AID CORPORATION 2021 Proxy Statement

Rite Aid associates have been at the Annual Meeting.What matters will be voted on at the Annual Meeting?

There are four proposals that are scheduled to be considered and voted on at the Annual Meeting:

•Proposal No. 1: Elect eight directors to hold office until the 2020 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified;

•Proposal No. 2: Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm;

•Proposal No. 3: Conduct an advisory vote to approve the compensationheart of our named executive officers as presented in this proxy statement;response to the pandemic, providing communities with the medications, essential supplies, and COVID-19 related information they need.

| | | We have taken numerous steps to ensure that Rite Aid can continue providing these vital services, including: | | |

| | | Serving Associates By: •

Implementing Hero Pay and Hero Bonus programs to show appreciation for the exceptional commitment of Rite Aid associates on the front lines. •

Instituting a temporary administrative leave program for associates who are 65+, at increased risk for severe illness from COVID-19, or not comfortable coming to work. ���

Instituting a temporary Pandemic Pay program that ensures associates are compensated if diagnosed with the virus or quarantined because of exposure. •

Implementing specific internal protocols to keep associates safe and ready to serve customers, including the installation of clear plastic barriers at pharmacy and front-end counters to provide additional protection. •

Providing associates with disposable masks, cloth face coverings, gloves, and face shields to protect them while at work. | | | Serving Customers By: •

Launching Rite Aid Virtual Care, telehealth powered by RediClinic to better serve patient needs. •

Designating a senior shopping hour to limit exposure for older customers or those at increased risk for severe illness. •

Establishing social distancing procedures that include marking floor areas in front of the pharmacy and front-end counters to show six feet of separation. •

Waiving delivery fees for eligible prescriptions. •

Following enhanced cleaning and sanitization protocols designed specifically to prevent the spread of a wide spectrum of viruses, including COVID-19 and influenza. •

Making complimentary masks available to customers. •

Making hand sanitizer and wipes available to customers and associates. | | |

Keeping Our Communities Safe From Opioid Abuse

On September 30, 2019, the Company released a dedicated report describing the Company’s leadership approach to ensuring the appropriate governance and oversight of opioid dispensing, treatment assistance and disposal, which is available on our website at

www.riteaid.com•Proposal No. 4: Consider a stockholder proposal seeking a By-Law amendment for a 10% ownership threshold for stockholders to call special meetings.

Table of Contents

Stockholders will also be asked to consider and vote at under the Annual Meetingheadings “Corporate—Governance—Our Policies—Board Report on any other matter that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. At this time, the Board of Directors is unaware of any matters, other than those set forth above, that may properly come before the Annual Meeting.

What are the Board's voting recommendations?

Opioids Oversight.” The Board recommendsis committed to ensuring that you vote "FOR" the nomineesCompany is developing solutions to curb prescription opioid abuse through the development and expansion of education, safe prescription drug disposal, and industry leading pharmacy safeguards.

![[MISSING IMAGE: tm217739d2-icon_hlthpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d2-icon_hlthpn.jpg)

Improving the Board Health and Wellbeing of Our Communities

| | | | | | | | | | | | | | | |

| | 77,000+ Naloxone Rx | | | | #3 Ranking | | | | 93,000 DisposeRx Packets | | | | 630+ Safe Disposal Kiosks | |

| | prescriptions dispensed to help address the opioid crisis | | | | in large chain overall performance for Medication Therapy Management Services by OutcomesMTM | | | | given out in Rite Aid stores | | | | installed in law enforcement facilities in our communities through support of The Rite Aid Foundation | |

RITE AID CORPORATION 2021 Proxy Statement | 3

Fiscal Year 2021 Performance and Operational Highlights2

| | | | | | | | | | | | | | | |

| | $24.0B Total Revenue | | | | $437.7M Adjusted EBITDA | | | | $1.7B Total Liquidity | | | | 9.6% Total Revenue Growth | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 450K Average Daily

Prescriptions | | | | 6,400 Pharmacists Serving

Our Communities | | | | 2,500 Retail Pharmacy Locations across 17 States | | | | 3.3M Elixir Members | |

STOCKHOLDER ENGAGEMENT EFFORTS

We regularly seek the election of directors, "FOR" the ratification of Deloitte & Touche LLP as the Company's independent registered public accounting firm, "FOR" the approval, on an advisory basis, of the compensationperspectives of our named executive officers as presented in this proxy statement, and "AGAINST" the stockholder proposal.What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, Broadridge Corporate Issuer Services, you are considered the "stockholder of record" with respect to those shares.

If your shares are held in a stock brokerage account or by a bank or other nominee, those shares are held in "street name" and you are considered the "beneficial owner" of the shares. As the beneficial owner of those shares, you have the right to direct your broker, bank, or nominee how to vote your shares, and you will receive separate instructions from your broker, bank, or other holder of record describing how to vote your shares.

How can I vote my shares before the Annual Meeting?

If you hold your shares in your own name, you may submit a proxy by telephone, via the Internet, or by mail.

•Submitting a Proxy by Telephone: You can submit a proxy for your shares by telephone until 11:59 p.m. Eastern Daylight Time on July 16, 2019, by calling the toll-free telephone number on the enclosed proxy card, 1-800-690-6903. Telephone proxy submission is available 24 hours a day. Easy-to-follow voice prompts allow you to submit a proxy for your shares and confirm that your instructions have been properly recorded. Our telephone proxy submission procedures are designed to authenticate stockholders' identities by using individual control numbers.

•Submitting a Proxy via the Internet: You can submit a proxy for your shares via the Internet until 11:59 p.m. Eastern Daylight Time on July 16, 2019, by accessing the website listed on the enclosed proxy card,www.proxyvote.com, and following the instructions you will find on the website. Internet proxy submission is available 24 hours a day. As with telephone proxy submission, you will be given the opportunity to confirm that your instructions have been properly recorded.

•Submitting a Proxy by Mail: If you choose to submit a proxy for your shares by mail, simply mark the enclosed proxy card, date and sign it, and return it in the postage paid envelope provided.

By casting your vote in any of the three ways listed above, you are authorizing the individuals listed on the proxy to vote your shares in accordance with your instructions. You may also attend the Annual Meeting and vote in person.

If your shares are held in the name of a bank, broker, or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted. The availability of telephonic or Internet voting will depend on the bank's, broker's, or other nominee's voting process. Please check with your bank, broker, or other nominee and follow the voting procedures your bank, broker, or other nominee provides to vote your shares. Also, please note that if the holder of record of

Table of Contents

your shares is a bank, broker, or other nominee and you wish to vote in person at the Annual Meeting, you must request a legal proxy from your bank, broker, or other nominee that holds your shares and present that proxy and proof of identification at the Annual Meeting; otherwise, you will not be able to vote in person at the Annual Meeting.

If I am the beneficial owner of shares held in "street name" by my broker, will my broker automatically vote my shares for me?

New York Stock Exchange ("NYSE") rules applicable to brokers grant your broker discretionary authority to vote your shares without receiving your instructions on certain matters. Your broker has discretionary voting authority under NYSE rules to vote your shares on the ratification of Deloitte & Touche LLP as our independent registered public accounting firm. However, unless you provide voting instructions to your broker, your broker does not have discretionary authority to vote on the election of directors, the advisory vote on the compensation of our named executive officers, and the vote on the stockholder proposal.Accordingly, it is particularly important that beneficial owners instruct their brokers how they wish to vote their shares.

How will my shares be voted if I give my proxy but do not specify how my shares should be voted?

If you provide specific voting instructions, your shares will be voted at the Annual Meeting in accordance with your instructions. If you hold shares in your name and sign and return a proxy card without giving specific voting instructions, your shares will be voted "FOR" the nominees of the Board in the election of directors, "FOR" the ratification of Deloitte & Touche LLP as the Company's independent registered public accounting firm, "FOR" the approval, on an advisory basis, of the compensation of our named executive officers, and "AGAINST" the stockholder proposal.

Could other matters be decided at the Annual Meeting?

At this time, we are unaware of any matters, other than those set forth above, that may properly come before the Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named in the enclosed proxy, or their duly constituted substitutes acting at the Annual Meeting or any adjournment or postponement of the Annual Meeting, will be deemed authorized to vote or otherwise act on such matters in accordance with their judgment.

Who may attend the Annual Meeting?

All stockholders are invited to attend the Annual Meeting. Persons who are not stockholders may attend only if invited by the Board of Directors. If you are the beneficial owner of shares held in the name of your broker, bank, or other nominee, you must bring proof of ownership (e.g., a current broker's statement) in order to be admitted to the meeting. You can obtain directions to the Annual Meeting by contacting our Investor Relations Department at (717) 975-3710.

Can I vote in person at the Annual Meeting?

Yes. If you hold shares in your own name as a stockholder of record, you may come to the Annual Meeting and cast your vote at the meeting by properly completing and submitting a ballot. If you are the beneficial owner of shares held in the name of your broker, bank, or other nominee, you must first obtain a legal proxy from your broker, bank, or other nominee giving you the right to vote those shares and submit that proxy along with a properly completed ballot at the meeting; otherwise, you will not be able to vote in person at the Annual Meeting.

Table of Contents

How can I change my vote?

You may revoke your proxy at any time before it is exercised by:

•Delivering to the Secretary a written notice of revocation, dated later than the proxy, before the vote is taken at the Annual Meeting;

•Delivering to the Secretary an executed proxy bearing a later date, before the vote is taken at the Annual Meeting;

•Submitting a proxy on a later date by telephone or via the Internet (only your last telephone or Internet proxy will be counted), before 11:59 p.m. Eastern Daylight Time on July 16, 2019; or

•Attending the Annual Meeting and voting in person (your attendance at the Annual Meeting, in and of itself, will not revoke the proxy).

Any written notice of revocation, or later dated proxy, should be delivered to:

Rite Aid Corporation

30 Hunter Lane

Camp Hill, Pennsylvania 17011

Attention: James J. Comitale, Secretary

Alternatively, you may hand deliver a written revocation notice, or a later dated proxy, to the Secretary at the Annual Meeting before we begin voting.

If your shares of Rite Aid common stock are held by a bank, broker, or other nominee, you must follow the instructions provided by the bank, broker, or other nominee if you wish to change your vote.

What is an "abstention" and how would it affect the vote?

An "abstention" occurs when a stockholder sends in a proxy with explicit instructions to decline to vote regarding a particular matter. Abstentions are counted as present for purposes of determining a quorum. An abstention with respect to the election of directors is neither a vote cast "for" a nominee nor a vote cast "against" the nominee and, therefore, will have no effect on the outcome of the vote. Abstentions with respect to the ratification of Deloitte & Touche LLP as our independent registered public accounting firm, the advisory vote on compensation of our named executive officers, and the vote on the stockholder proposal will have the same effect as voting "against" the proposal.

What is a broker "non-vote" and how would it affect the vote?

A broker non-vote occurs when a broker or other nominee who holds shares for the beneficial owner is unable to vote those shares for the beneficial owner because the broker or other nominee does not have discretionary voting power for the proposal and has not received voting instructions from the beneficial owner of the shares. Brokers will have discretionary voting power to vote shares for which no voting instructions have been provided by the beneficial owner only with respect to the ratification of Deloitte & Touche LLP as our independent registered public accounting firm. Brokers will not have such discretionary voting power to vote shares with respect to the election of directors, the advisory vote on the compensation of our named executive officers, and the vote on the stockholder proposal. Shares that are the subject of a broker non-vote are included for quorum purposes, but a broker non-vote with respect to a proposal will not be counted as a vote cast and will not be counted as a vote represented at the meeting and entitled to vote and, consequently, will have no effect on the outcome of the vote. Accordingly, it is particularly important that beneficial owners of Rite Aid shares instruct their brokers how to vote their shares.

Table of Contents

What are the quorum and voting requirements for the proposals?

In deciding the proposals that are scheduled for a vote at the Annual Meeting, each holder of common stock as of the record date is entitled to one vote per share of common stock. In order to take action on the proposals, a quorum, consisting of the holders of 26,914,351 shares (a majority of the aggregate number of shares of Rite Aid common stock) issued and outstanding and entitled to vote as of the record date for the Annual Meeting, must be present in person or by proxy. This is referred to as a "quorum." Proxies marked "Abstain" and broker non-votes will be treated as shares that are present for purposes of determining the presence of a quorum.

The affirmative vote of a majority of the total number of votes cast is required for the election of each director nominee named in Proposal No. 1. This means that the votes cast "for" that nominee must exceed the votes cast "against" that nominee. Any shares not voted (whether by abstention, broker non-vote or otherwise) will not be counted as votes cast and will have no effect on the outcome of the vote. For more information on the operation of our majority voting standard, see the section entitled "Board of Directors—Corporate Governance—Majority Voting Standard and Policy."

The affirmative vote of a majority of the shares represented at the meeting and entitled to vote is required for the ratification of Deloitte & Touche LLP as our independent registered public accounting firm in Proposal No. 2. Any shares represented and entitled to vote at the meeting and not voted (whether by abstention or otherwise) will have the same effect as a vote "against" the proposal.

The affirmative vote of a majority of the shares represented at the meeting and entitled to vote is required for the approval of the advisory vote on the compensation of our named executive officers in Proposal No. 3. Any shares represented and entitled to vote at the meeting and not voted (whether by abstention or otherwise) will have the same effect as a vote "against" the proposal. Any broker non-votes with respect to the advisory vote on the compensation of our named executive officers will not be counted as shares represented at the meeting and entitled to vote and, consequently, will have no effect on the outcome of the vote.

The affirmative vote of a majority of the shares represented at the meeting and entitled to vote is required for the approval of the stockholder proposal in Proposal No. 4. Any shares represented and entitled to vote at the meeting and not voted (whether by abstention or otherwise) will have the same effect as a vote "against" the stockholder proposal. Any broker non-votes with respect to the stockholder proposal will not be counted as shares represented at the meeting and entitled to vote and, consequently, will have no effect on the outcome of the vote.

What happens if a quorum is not present at the Annual Meeting?

If the shares present in person or represented by proxy at the Annual Meeting are not sufficient to constitute a quorum, the stockholders by a vote of the holders of a majority of votes present in person or represented by proxy (which may be voted by the proxyholders) may, without further notice to any stockholder (unless a new record date is set), adjourn the meeting to a different time and place to permit further solicitations of proxies sufficient to constitute a quorum.

Table of Contents

Who will count the votes?

Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspectors of election.

Who will conduct the proxy solicitation and how much will it cost?

We are soliciting proxies from stockholders on behalf ofissues important to them. Through our quarterly financial performance webcasts, analyst conferences, investor meetings and calls, we obtain, process and share stockholder feedback with our Board and will pay for all costs incurred by it in connection with the solicitation. In addition to solicitation by mail, the directors, officerscommittees. Our Compensation Committee considers investor perspectives when making decisions on executive compensation, and associates of Rite Aid and its subsidiaries may solicit proxies from stockholders of Rite Aid in person or by telephone, facsimile, or email without additional compensation other than reimbursement for their actual expenses.

We have retained Morrow Sodali, LLC, a proxy solicitation firm, to assist us in the solicitation of proxies for the Annual Meeting. Rite Aid will pay Morrow Sodali a fee of approximately $20,000, plus reasonable out-of-pocket expenses.

Arrangements also will be made with brokerage firms and other custodians, nominees, and fiduciaries for the forwarding of solicitation material to the beneficial owners of stock held of record by such persons, and we will reimburse such custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses in connection with the forwarding of solicitation materials to the beneficial owners of our stock.

If you have any questions about voting your shares or attending the Annual Meeting, please call our Investor Relations Department at (717) 975-3710.

Table of Contents

STOCKHOLDER ENGAGEMENT, MANAGEMENT TRANSITION, AND BOARD REFRESHMENT

Since the termination of the Albertsons transaction in August 2018 and following the 2018 Annual Meeting, we have engaged in enhanced stockholder outreach efforts. These efforts provided an opportunity for independent directors to hear from stockholders directly regarding their perspectives and concerns. In addition, management has communicated with many retail stockholders and received their feedback. We greatly value the insightful input about the Company that our stockholders have provided in these and other exchanges over the past ten months. The feedback from these efforts has been summarized, shared, and considered by the Nominating and Governance Committee and the full Board.

Investors raised a number of concerns and the Board has taken significant steps to address these items. Specifically, the principal issues raised by our stockholders related to: (1) Board refreshment, (2) an evaluation of management, (3) corporate governance matters, and (4) the Company's sustainability efforts.

New Board Leadership and Composition

In the course of our stockholder engagement meetings over the past ten months, stockholders expressed concerns regarding the lack of Board refreshment in recent years, as well as concerns regarding our Board governance. The Board reviewed its structure in light of the Company's current operating and governance environment and, effective at the 2018 Annual Meeting, Mr. Standley was succeeded as Chairman of the Board by Bruce G. Bodaken. Subsequently, in December 2018, the Board amended the Company's By-Laws to provide that the Chairman of the Board shall be a director who is independent under the NYSE listing standards and the Company's Corporate Governance Guidelines.

The Board has significantly accelerated its efforts to change the composition of the Board. As part of this process, at the 2018 Annual Meeting, three of the eight independent directors did not stand for reelection and the Board nominated three new independent directors. As a continuation of this process, two new directors were appointed by the Board following the resignation of two of our directors in April 2019. The five directors who have joined the Board over the past eight months will continue to bring fresh perspectives to the Board. In addition, Mr. Standley has not been nominated for reelection at the Annual Meeting.

As a result of these changes in the Board's composition, the average tenure of our independent directors has decreased from approximately eight years prior to the 2018 Annual Meeting to approximately four years, with a relatively even distribution among new directors and directors of longer tenure. Through the Board refreshment process, the Board has increased the racial and ethnic diversity on the Board, with half of the Board being racially and ethnically diverse following the Annual Meeting. The Board also made gender diversity a priority as part of its most recent phase of its refreshment, resulting in more than one-third of our Board being women following the Annual Meeting.

Management Transition

One of the Board's most important tasks is choosing the Company's Chief Executive Officer. Following the 2018 Annual Meeting, the Board continued to engage in rigorous and thoughtful evaluation and discussion regarding the Chief Executive Officer and other management positions. In March 2019, the Company announced a leadership transition and organizational restructuring to better align its structure with the Company's operations and to reduce costs. As part of the leadership transition, the Company announced that the Board would be commencing a search process for a new Chief Executive Officer. Mr. Standley will continue to serve as Chief Executive Officer of the Company until the appointment of his successor but has not been nominated for reelection to the Board at the

Table of Contents

Annual Meeting. The Company also announced additional management changes, which were effective in March 2019, and consolidated additional senior leadership roles that resulted in the elimination of certain positions.

Additional Corporate Governance Changes

Since the 2018 Annual Meeting, the Board has considered and taken action with respect to certain corporate governance practices. In discussions with stockholders, some stockholders expressed a desire for Rite Aid stockholders to have the right to call a special meeting. In addition, our Nominating and Governance Committee has been monitoring trendsconsiders investor views regarding Board composition and developments relatingcorporate governance matters. Due to special meeting rights. feedback we received in fiscal year 2021, we increased our efforts to engage with stockholders as follows:

| | | | | | | | | | | |

| | WHO WE CONTACTED | | | | HOW WE ENGAGED | | | | WHAT WE DISCUSSED | |

| | During fiscal year 2021 we reached out to holders representing over 50% of our outstanding stock. Holders representing over 25% of our outstanding stock participated in meetings. We also engaged with leading proxy advisors to discuss executive compensation matters. | | | | We annually invite our largest 20+ stockholders

to individual meetings (or videoconferences) to discuss items of importance to them, such as executive compensation and Board and corporate governance matters. The Chair of the Compensation Committee and senior management participated. | | | | •

Executive Compensation design elements and alignment with stockholders •

The importance of environmental, social and governance (ESG) initiatives, particularly related to carbon emissions reductions and renewable energy strategies •

Issuing a climate related financial disclosure report using the Task Force on Climate-related Financial Disclosures (TCFD) framework •

Board level oversight over ESG and energy and emissions reduction goals •

Board level oversight of diversity, equity and inclusion (DEI) strategy •

Strategy and efforts around hiring, training and retaining a diverse workforce | |

| | | | | OUR RESPONSES | |

| | •

Committed to more ESG transparency, including issuing a report in 2021 using TCFD standards, amended the Board’s nominating and governance committee charter to expand its oversight role to include ESG matters, created a cross-functional management steering committee on sustainability, and strengthened governance of climate risk through the Enterprise Risk Management program. •

Demonstrated the commitment to DEI by amending our Board’s compensation committee charter to include oversight of diversity, equity, and inclusion matters, hired a Vice President of DEI to develop and execute our DEI strategy, issued a CEO statement of intolerance of discrimination and injustice, and supported the Rite Aid Foundation and other nonprofit organizations’ advocacy for racial equity, awareness, and progress in the United States. | |

2

As of February 27, 2021.

4 | RITE AID CORPORATION 2021 Proxy Statement

We have added 7 new directors to our Board since 2018, all of whom are either women or racially or ethnically diverse.

RITE AID CORPORATION 2021 Proxy Statement | 5

| | | | | | | | Committees | |

| | Director and Principal Occupation | | | Age | | | Director

Since | | | Independent | | | Audit | | | Compensation | | | Nominating and

Governance | |

| | | | | BRUCE G. BODAKEN Former Chairman and Chief Executive

Officer, Blue Shield of California | | | 69 | | | 2013; since

2018 | | | | | | | | | | | | | |

| | | | | ELIZABETH “BUSY” BURR President and Chief Commercial

Officer, Carrot Inc. | | | 59 | | | 2019 | | | | | | | | | | | | | |

| | | | | HEYWARD DONIGAN President and Chief Executive Officer,

Rite Aid Corporation | | | 60 | | | 2019 | | | | | | | | | | | | | |

| | | | | BARI HARLAM Co-Founder, Trouble LLC; and former

EVP, Chief Marketing Officer North

America, Hudson’s Bay Company | | | 59 | | | 2020 | | | | | | | | | | | | | |

| | | | | ROBERT E. KNOWLING, JR. Chairman, Eagles Landing Partners | | | 65 | | | 2018 | | | | | | | | | | | | | |

| | | | | KEVIN E. LOFTON Former Chief Executive Officer,

CommonSpirit Health | | | 66 | | | 2013 | | | | | | | | | | | | | |

| | | | | LOUIS P. MIRAMONTES Former Managing Partner of the

San Francisco office and Senior Partner

for Latin America, KPMG LLP | | | 66 | | | 2018 | | | | | | | | | | | | | | | | |

| | | | | ARUN NAYAR Former Executive Vice President

and Chief Financial Officer,

Tyco International | | | 70 | | | 2018 | | | | | | | | | | | | | | | | |

| | | | | KATE B. QUINN Vice Chairman and Chief

Administrative Officer, U.S. Bancorp | | | 56 | | | 2019 | | | | | | | | | | | | | |

| | | | | Committee Chair | | | | | | Committee Member | | | | | | Chair of the Board | | | | | | Audit Committee Financial Expert | |

BOARD AND GOVERNANCE HIGHLIGHTS

| | | |

| | All Board members are independent except the President and Chief Executive Officer Diverse chairs for Audit, Compensation and Nominating and Governance Committees Independent Chair of the Board All directors elected annually Majority voting for directors in uncontested elections Proxy access provisions in bylaws | | | Holders of 10% of outstanding stock may call a special meeting of stockholders Mandatory director retirement age of 72 Meaningful stock ownership requirements for the Board and executive officers Anti-hedging and anti-pledging policy for the Board and all associates Annual evaluation of the Board and committees | |

6 | RITE AID CORPORATION 2021 Proxy Statement

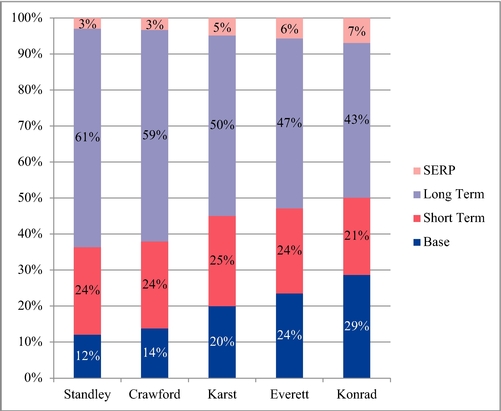

EXECUTIVE COMPENSATION OVERVIEW

Philosophy and Objectives

Our executive compensation program is based on a resultpay-for-performance philosophy and is designed to accomplish the following goals:

![[MISSING IMAGE: tm217739d2-tbl_philosopypn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d2-tbl_philosopypn.jpg)

| | ![[MISSING IMAGE: tm217739d1_ic-checkpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d1_ic-checkpn.jpg) WHAT WE DO WHAT WE DO | | | | | | ![[MISSING IMAGE: tm217739d2_ic-xk.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d2_ic-xk.jpg) WHAT WE DON’T DO WHAT WE DON’T DO | |

| | Conduct annual stockholder advisory vote on the compensation of our named executive officers Maintain dialogue with stockholders on various topics, including executive pay practices Retain an independent executive compensation consultant to the Compensation Committee Ensure that a significant portion of executive officer total target remuneration is at risk Provide annual and long-term incentive plans with performance targets aligned to business goals | | | Require a designated level of stock ownership for all named executive officers Require equity awards to have a double trigger (qualifying termination of employment and change in control) Complete an annual incentive compensation risk assessment Maintain a formal clawback policy for executive officers | | | | | | Provide gross-up payments to cover personal income taxes or excise taxes related to executive severance benefits Permit executives to engage in hedging or pledging of Rite Aid securities Reward executives for imprudent, inappropriate, or unnecessary risk-taking Allow the repricing of equity awards without stockholder approval | |

RITE AID CORPORATION 2021 Proxy Statement | 7

Total Target Compensation

HUMAN CAPITAL MANAGEMENT EFFORTS

We are proud to employ over 50,000 associates across the United States, including Puerto Rico. Our associates are key to the success of these discussionsour transformation as they are at the center of supporting the whole health of our customers and trends,communities. We are optimizing our workforce through enhanced communication and engagement through the following measures:

•

annual and periodic pulse surveys in April 2019,which more than 70% of our associates have participated;

•

increased personal and professional associate development opportunities, including training on leadership, safety, compliance, and other critical business skills;

•

discounted tuition and reimbursement programs for associates to pursue degrees at select colleges or universities;

•

certification as an Accredited Provider of Continuing Pharmacy Education, which allows us to offer courses that count toward the Board amendedcontinuing education licensing requirements of our pharmacists;

•

offering an accredited pharmacy technician certification program;

•

compensation and benefit programs to support, recognize and reward performance of our associates (including annual bonuses, 401(k) plans, health care benefits, paid time off, life and disability coverage, merchandise discounts, and many other services and programs);

•

associate wellness programs and tools for whole health in areas such as mental health, disease management, and financial wellness; and

•

an associate recognition program that incorporates financial incentives to celebrate the Company's By-Lawsachievements of our teams and create a community experience for our workforce.

DIVERSITY, EQUITY AND INCLUSION EFFORTS

Just as we are transforming our business, we are also transforming our approach to permit special meetings of the stockholders of the CompanyDiversity, Equity & Inclusion (DEI). We are being more intentional to ensure that we have not only a diverse workforce but an environment in which our talent can thrive. We are proud to be called by stockholders holding at least 20%a part of diverse communities and to have a workforce that reflects the Company's common stock. Atdiversity of our customers and the 2018 Annual Meeting, stockholders approvedcommunities in which we operate. As such, we believe that an inclusive and welcoming culture is essential, and our commitment to diversity comes from the top. We are proud to have a proposal requestingBoard with 89% overall diversity, which is composed of 44% gender diversity and 44% ethnic/

racial diversity. We are focused on strengthening our DEI infrastructure, which includes the development of a DEI team (a Center of Excellence) and a DEI integrated strategy that will address talent processes such as talent acquisition, talent development and talent management. A key focus will be to develop solutions that seek to enhance the work environment so our associates can perform to their best potential and provide an optimum customer experience. Our experienced Vice President of Diversity, Equity & Inclusion focuses on developing and executing our DEI strategy.

As of December 31, 2020, 67% of associates self-reported as female. In addition, associates self-reported their race/ethnicity as: White 56%; Hispanic 15%; Black 13%; Asian 11%; and Other 5%.

8 | RITE AID CORPORATION 2021 Proxy Statement

ENVIRONMENTAL, SOCIAL & GOVERNANCE EFFORTS

As discussed in more detail in the section on Corporate Governance and Board Matters below, Rite Aid prepareis committed to integrating Environmental, Social, and Governance (ESG) initiatives into our operations, not only to create value for our stockholders, customers, and associates, but also because we are deeply invested in our communities, and our customers want to support a sustainability report describing the Company'scompany that supports their safety and our environment.

In fiscal year 2021, we made a concerted effort to enhance our strategy and overall approach to sustainability. The strategy was influenced by reporting frameworks, conversations with stockholders, stakeholder expectations, and emerging trends. We identified several key areas of opportunity to expand our environmental, social and governance ("ESG") riskscommitments, most notably around diversity, equity and opportunities. The Company anticipatesinclusion, human capital management, climate change and board oversight of ESG matters.

We also recognize that a report describing the Company's ESGclimate risk is investment risk, and transparency regarding climate-related risks and opportunities is crucial to maintaining the trust of our stakeholders. This also allows our investors to better understand the implications of climate change on our business. In fiscal year 2021, we took a comprehensive look at how we understand and manage the risks and opportunities associated with climate change and began incorporating this into our long term strategy. Some of our fiscal year 2021 highlights include:

Energy Management, Energy Production & Waste Reduction

| | | | | | | | | | | | | | | |

| | ![[MISSING IMAGE: tm217739d1-icon_arrowdnpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d1-icon_arrowdnpn.jpg) 63% 63%Waste Reduction | | | | 35% Of Our Stores | | | | 50% Renewable Power | | | | 50,000+ Tons | |

| | related to decreased pharmaceutical hazardous waste generation | | | | | | | | now have LED lighting,

8% year-over-year increase | | | | provided at 49 California Rite Aid locations | | | | of recyclable materials from our operating locations diverted from landfills last year | |

GHG Emissions & Fuel Reduction

| | | | | | | | | | | | | | | |

| | 2,638 Metric Tons | | | | 300,000 Gallons | | | | ![[MISSING IMAGE: tm217739d1-icon_arrowdnpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d1-icon_arrowdnpn.jpg) 12% 12%Passenger Fleet

Reduction | | | | 62,000 Gallons | |

| | reduction in emissions last year by eliminating passenger fleet vehicles | | | | of fuel saved by reducing passenger fleet vehicles | | | | by eliminating passenger vehicles | | | | of fuel saved last year, by implementing use of distribution software, resulting in 8.3% fewer miles driven | |

RITE AID CORPORATION 2021 Proxy Statement | 9

Managing Chemicals of Concern

As we position Rite Aid as a whole health destination that elevates mind, body and spirit, one of our core tenets remains providing our customers with the best products, services and advice to meet their unique needs. Our customers want to feel confident about what is in the products they are using for themselves and their families.

In 2016, Rite Aid committed to eliminate eight chemicals of high concern (the “Evil 8”) from its private brand formulated products by 2020. In 2018, we adopted our Chemical Policy and corresponding restricted substance list (RSL), which outlines our commitment to the ongoing management of toxic chemicals and safety of the products on our shelves.

| | | In 2021, Rite Aid was ranked 7th

out of 50 of the largest retailers

in North America for its

management of toxic chemicals

by the annual Who’s Minding

the Store? Retailer Report Card. | | |

| | | View the retailer report card at

retailerreportcard.com/grades | | |

| | | Website content is not incorporated into this proxy statement. | | |

In 2020, our primary focus was to meet our goal of eliminating Evil 8 chemicals from the primary formulations of private brand products. As of March 2021, only 13 formulas (1% of our assortment) contained Evil 8 chemicals. We are actively transitioning out of or working with supplier partners to reformulate these last few items with safer alternatives.

We are proud of the progress we’ve made in reducing the presence of chemicals of concern, which is essential to the future success of our own brands. To that end, we’ve embarked on an ambitious, multi-year initiative to re-architect our own brands program where “clean ingredients” will not only be celebrated, but will be released prior to the Annual Meeting. Additional details regarding the Company's considerationa core component of sustainability mattersour positioning across brands and the related business initiatives the Company has undertaken in recent years are described in the section entitled "Board of Directors—Sustainability." At the 2018 Annual Meeting, stockholders approved a proposal requesting that Rite Aid prepare a report describing the corporate governance changes the Company has implemented since 2012 to more effectively monitorcategories, including health, beauty, personal care, consumables, household and manage financial and reputational risks related to the opioid crisis. The Company anticipates that a report describing the Company's approach to oversight of opioid matters will be released by October 1, 2019. Additional details regarding the Company's oversight of opioid matters and the related business initiatives the Company has undertaken in recent years are described in the section entitled "Board of Directors—Opioid Matter Oversight."

more. | | | | For more information, please see Rite Aid’s 2020 CSR Report at https://www.riteaid.com/content/dam/riteaid-web/corporate/rite-aid-corporate-social-responsibility-report-2020.pdf Website content is not incorporated into this proxy statement. | | |

10 | RITE AID CORPORATION 2021 Proxy Statement

| | | | | | PROPOSAL 1—ELECTION OF DIRECTORS | | |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

Our By-Laws provide that the Board of Directors may be composed of up to 15 members, with the number to be fixed from time to time by the Board. The Board has fixed the number of directors at eight effective as of the Annual Meeting,nine, and there are eightnine nominees for director at our Annual Meeting.

All directors are elected annually.

Director NomineesThe Board of Directors, based on the recommendation of the Nominating and Governance Committee, has nominated Bruce G. Bodaken, Elizabeth 'Busy' Burr, Robert E. Knowling, Jr., Kevin E. Lofton, Louis P. Miramontes, Arun Nayar, Katherine Quinn, and Marcy Symsthe following individuals to be elected directors at the Annual Meeting. Meeting:

| | •

Bruce G. Bodaken | | | •

Bari Harlam | | | •

Louis P. Miramontes | |

| | •

Elizabeth “Busy” Burr | | | •

Robert E. Knowling, Jr. | | | •

Arun Nayar | |

| | •

Heyward Donigan | | | •

Kevin E. Lofton | | | •

Kate B. Quinn | |

Each of the nominees for director to be elected at the Annual Meeting currently serves as a director of the Company. Mr. Standley will continue to serve as Chief Executive Officer of the Company until the appointment of his successor but has not been nominated for reelection at the Annual Meeting.Each director elected at the Annual Meeting will hold office until the 20202022 Annual Meeting of Stockholders. Each director elected at the Annual MeetingStockholders and will serve until his or her successor is duly elected and qualified.

If any nominee at the time of election is unable or unwilling tocannot serve or is otherwise unavailable for election, and as a consequence thereof other nominees areanother nominee is designated, then the persons named in the proxyproxies or their substitutes will have the discretion and authority to vote or to refrain from voting for such other nomineesnominee in accordance with their judgment.judgment, or the Board may reduce the size of the Board.

| | | | | | The Board of Directors unanimously recommends that you vote FOR the election of each of the nominees listed above. | | |

RECOMMENDATION

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THE ELECTION OF EACH OF THE NOMINEES LISTED ABOVE.

BOARD OF DIRECTORS

The following table sets forth certain information as of May 31, 201920, 2021 with respect to our director nominees. If elected, the term of each of the following persons will expire at the 2020 Annual Meeting of Stockholders.

| | Name | | | Age | | | Position with Rite Aid | | | Year First

Became Director | |

| | Heyward Donigan | | | 60 | | | President, Chief Executive Officer and Director | | | 2019 | |

| | Bruce G. Bodaken | | | 69 | | | Chair | | | 2013 | |

| | Elizabeth “Busy” Burr | | | 59 | | | Director | | | 2019 | |

| | Bari Harlam | | | 59 | | | Director | | | 2020 | |

| | Robert E. Knowling, Jr. | | | 65 | | | Director | | | 2018 | |

| | Kevin E. Lofton | | | 66 | | | Director | | | 2013 | |

| | Louis P. Miramontes | | | 66 | | | Director | | | 2018 | |

| | Arun Nayar | | | 70 | | | Director | | | 2018 | |

| | Kate B. Quinn | | | 56 | | | Director | | | 2019 | |

| | | | | | | | | |

Name | | Age | | Position with Rite Aid | | Year First

Became

Director | |

|---|

| Bruce G. Bodaken | | | 67 | | Chairman | | | 2013 | |

| Elizabeth 'Busy' Burr | | | 57 | | Director | | | 2019 | |

| Robert E. Knowling, Jr. | | | 63 | | Director | | | 2018 | |

| Kevin E. Lofton | | | 64 | | Director | | | 2013 | |

| Louis P. Miramontes | | | 64 | | Director | | | 2018 | |

| Arun Nayar | | | 68 | | Director | | | 2018 | |

| Katherine Quinn | | | 54 | | Director | | | 2019 | |

| Marcy Syms | | | 68 | | Director | | | 2005 | |

Table of Contents

Board Composition

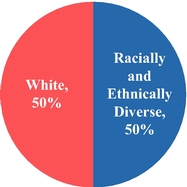

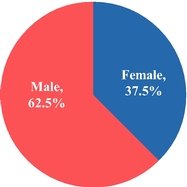

The Board is committed to ensuring that it is composed of a highly capable and diverse group of directors who are well-equipped to oversee the success of the business and effectively represent the interests of stockholders. In addition, the Board believes that having directors with both longer and shorter tenures on the Board helps transition the knowledge of the more experienced directors while providing a broad, fresh set of perspectives and a Board with a diversity of experiences and viewpoints. As discussed in the section entitled "Stockholder Engagement, Management Transition, and Board Refreshment" above, theThe Board has significantly accelerated its efforts to change the composition of the Board over the past eight months.three years. As a result, approximately forty-four percent of the director nominees are racially or ethnically diverse and approximately forty-four percent of the director nominees are women. In addition to enhancing the Board’s racial, ethnic and gender diversity, these changes bring a diversity of thought and experience to the Board. All of the nominees of the Board, other than Ms. Donigan, are independent directors.

As a result of these changes in the Board's composition, the average tenure of our independent directors has decreased from approximately eight years prior to the 2018 Annual Meeting to approximately four years, with a relatively even distribution among

RITE AID CORPORATION 2021 Proxy Statement | 11

PROPOSAL 1—ELECTION OF DIRECTORS

We have added 7 new directors and directors of longer tenure. In addition, half of the Board will be racially and ethnically diverse following the Annual Meeting. The Board also made gender diversity a priority as part of its most recent phase of its refreshment, resulting in more than one-third ofto our Board being women following the Annual Meeting.since 2018, including one in 2020.

| | |

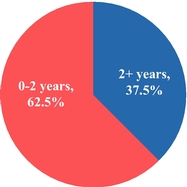

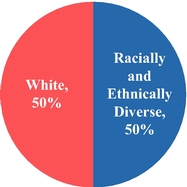

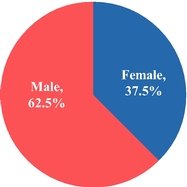

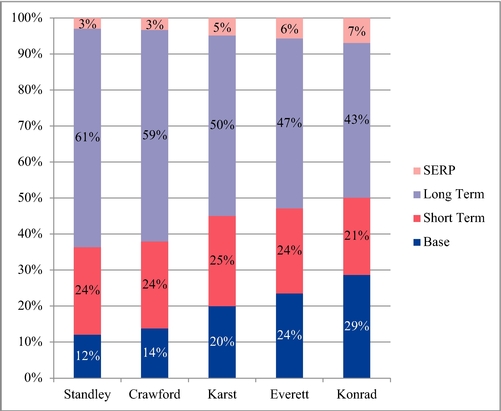

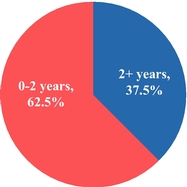

Director Tenure* | | Board Racial and Ethnic Diversity* |

|

|

|

Board Gender Diversity* |

|

Board Attributes

*The compositions depicted include calculations effective following the Annual Meeting.

![[MISSING IMAGE: tm217739d2-pc_boardpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d2-pc_boardpn.jpg)

In assessing Board composition and selecting and recruiting director candidates, the Board seeks to maintain an engaged, independent Board with broad experience and judgment that is committed to representing the long-term interests of our stockholders. The Nominating and Governance Committee considers a wide range of factors, including the size of the Board, the experience and expertise of existing Board members, other positions the director candidate has held or holds (including other

Table of Contents

board memberships), and the candidate'scandidate’s independence. In addition, the Nominating and Governance Committee takes into account a candidate'scandidate’s ability to contribute to the diversity of background and experience represented on the Board, and it reviews its effectiveness in balancing these considerations when assessing the composition of the Board. The

12 | RITE AID CORPORATION 2021 Proxy Statement

PROPOSAL 1—ELECTION OF DIRECTORS

Board

Skills and

Nominating and Governance Committee will continue to evaluate the composition of the Board as a whole as part of its ongoing refreshment in the coming year. Since the 2018 Annual Meeting, the Nominating and Governance Committee sought to continue the process of recruiting additional Board members whose qualifications align with the Company's refreshment process and long-term strategy. After considering a number of candidates and comprehensively reviewing these candidates' abilities and qualifications in sourcing candidates to fill the vacancies on the Board due to Joseph B. Anderson's and Michael N. Regan's resignations, the Nominating and Governance Committee recommended Busy Burr and Katherine Quinn for appointment to the Board. The Board appointed both candidates as directors in April 2019.

Experiences

The chart below summarizes the qualifications, attributes, skills and skillsexperiences for each of our director nominees. The fact that we do not list a particular experience or qualification for a director nominee does not mean that nominee does not possess that particular experience or qualification.| | | | | Skills and Experiences | |

| | Director | | | Board and

Corporate

Governance | | | Current or

Former CEO | | | Finance and

Accounting | | | Healthcare

Industry | | | Management

and

Business

Operations | | | Retail

Industry | |

| | Bruce G. Bodaken ![[MISSING IMAGE: tm217739d1_ic-stark.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-069882/tm217739d1_ic-stark.jpg) | | | | | | | | | | | | | | | | | | | |

| | Elizabeth “Busy” Burr | | | | | | | | | | | | | | | | | | | |

| | Heyward Donigan | | | | | | | | | | | | | | | | | | | |

| | Bari Harlam | | | | | | | | | | | | | | | | | | | |

| | Robert E. Knowling, Jr. | | | | | | | | | | | | | | | | | | | |

| | Kevin E. Lofton | | | | | | | | | | | | | | | | | | | |

| | Louis P. Miramontes | | | | | | | | | | | | | | | | | | | |

| | Arun Nayar | | | | | | | | | | | | | | | | | | | |

| | Kate B. Quinn | | | | | | | | | | | | | | | | | | | |

| | Total of 9 Directors | | | 9 | | | 5 | | | 3 | | | 5 | | | 9 | | | 4 | |

| | 100% | | | 56% | | | 33% | | | 56% | | | 100% | | | 44% | |